October 28, 2022

●

One of the most finicky parts of picking a payment gateway is understanding exactly what merchant fee you are paying. Every provider has a slightly different approach to setting their fees, and to make things a bit trickier, most of the time it’s hard to determine at the first glance how your fee is built up. Or sometimes quite the opposite: you might see a price point that’s just too good to be true – and trust us, your hunch is right in cases like these.

We’ll see to the bottom of it all – so if you’re in the process of opening a webshop or just want to switch payment gateways, this article will give you all the context you need.

What parties are involved in the payment process?🤝

To understand what you’re paying to whom, let’s first see the various parties that charge every transaction for every single payment made on your webshop.

The issuing bank: This is the bank of the cardholder’s owner. The amount paid to them is also known as the interchange fee. This is typically between 0.2-0.3% depending on whether it’s a credit or a debit card.

The card scheme: The scheme provider (usually Mastercard and Visa) gets a small fee for each payment. This ranges between 0.1-0.4%.

The acquirer: This is the organization that authorizes payments – they receive a fee for each transaction. This is also what includes the payment provider markup.

These three combined are also called Interchange++ (or IC++), in which IC stands for the issuing bank, the first + stands for the scheme fee, and the second + stands for the acquirer’s fee. We can also call it the merchant fee as this, in an ideal world, shows exactly what percentage you need to pay for each transaction (usually between 0.5-5%).

What’s the catch with merchant fees?💸

As you can see, merchant fees are pretty complex, and as such, it’s easy to sell merchants a payment gateway through an idealized example that only pertains to one part of the entire fee. So, if we take the best scenario (a domestic private debit card), your fee might be well below 1%. That’s great, but what happens if someone shops with a credit card? Or uses a company card? What if your customer has a foreign card? Your merchant fee will suddenly be much higher than what you were sold at first, and if the majority of your audience doesn’t fall into the ideal scenario, you’ll find yourself paying much more for the gateway provider you thought you would.

The writing is on the wall: always read the fine print and understand your audience and their buying habits. Get in touch with providers and ask for a quote that’s tailor-made for your business, and actively look for transparent providers that provide every little detail on their pricing page. If you know what type of cards are used for your transactions, it’s much easier to see through various payment gateways and their merchant fees. There’s another catch, however…

How are payment providers hiding their fees?🔍

One way is to simply misunderstand what these percentages mean. When you see that a gateway provider is asking for say, a merchant fee of 2%, it almost feels negligible. You keep 98% of the payment, right? Well, things get a bit more nuanced once you check your average cart size. Let’s say your webshop’s average visitor spends 120 euros on their cart. The merchant fee for each transaction is 2.4 euros (2% of the 120€) – not too shabby, right?

Now let’s see a provider that charges you less than half, say, 0.75%. The merchant fee you pay in the same scenario will be 0.9 euros. The difference is minuscule. Assuming that your fictional webshop generates 120,000 euros of income each month, in scenario A, you’re paying 240 euros to the provider, while in scenario B, it’s 90 euros. 150 euros is a measurable difference already, but tricky fees don’t stop here.

Another way of getting a higher merchant fee is by charging you a monthly fee on top of the percentage. This is typically for webshops with a smaller volume – still, the flat fee means that you need to pay the price even if the business isn’t booming. If your webshop specializes in seasonal offers (like Christmas), this is a particularly disadvantageous setup.

On top of everything, providers can still add a flat fee for each transaction. For instance, you could pay 0.25 euros for each transaction made, which, again doesn’t feel much, but let’s put it into context! If your payment gateway provider charges you a monthly fee, a flat transaction fee, plus a set % for each payment, you’ll be paying much more than what the first numbers suggested.

Sticking to a similar scenario from earlier, imagine that in case A you pay a 10-euro monthly fee, a 0.75% merchant fee plus 0.25 euros per transaction. With a 120-euro average cart value and 120,000-euro monthly income, it’ll cost 350 euros for your business. In scenario B, you have a flat merchant fee of 0.75%, so your cost will stay the same (90€):

The difference is glaring (almost 4X price difference), yet both providers in our fictional scenarios will roll with the same figure on their website (0.75% merchant fee).

Barion Smart Gateway: no surprises, just low fees ⛩️

No monthly fees, no extra transactional fees, just a flat percentage, custom-made for every business. Our price calculator comes in handy while determining your cost, but most setups cost our merchants between 0.5-1.5%. What you see is what you get: we don’t add anything on top – no disclaimers, no fine print.

Choosing the best gateway is, of course, not just a matter of price point: it’s important to how the integration goes, what features are there, what payment types are accepted, and so on. While navigating through your options (and before committing to integrating any payment gateway), though, always keep in mind to check what’s behind catchy numbers and low percentages.

More like this

FinTech

November 30, 2022

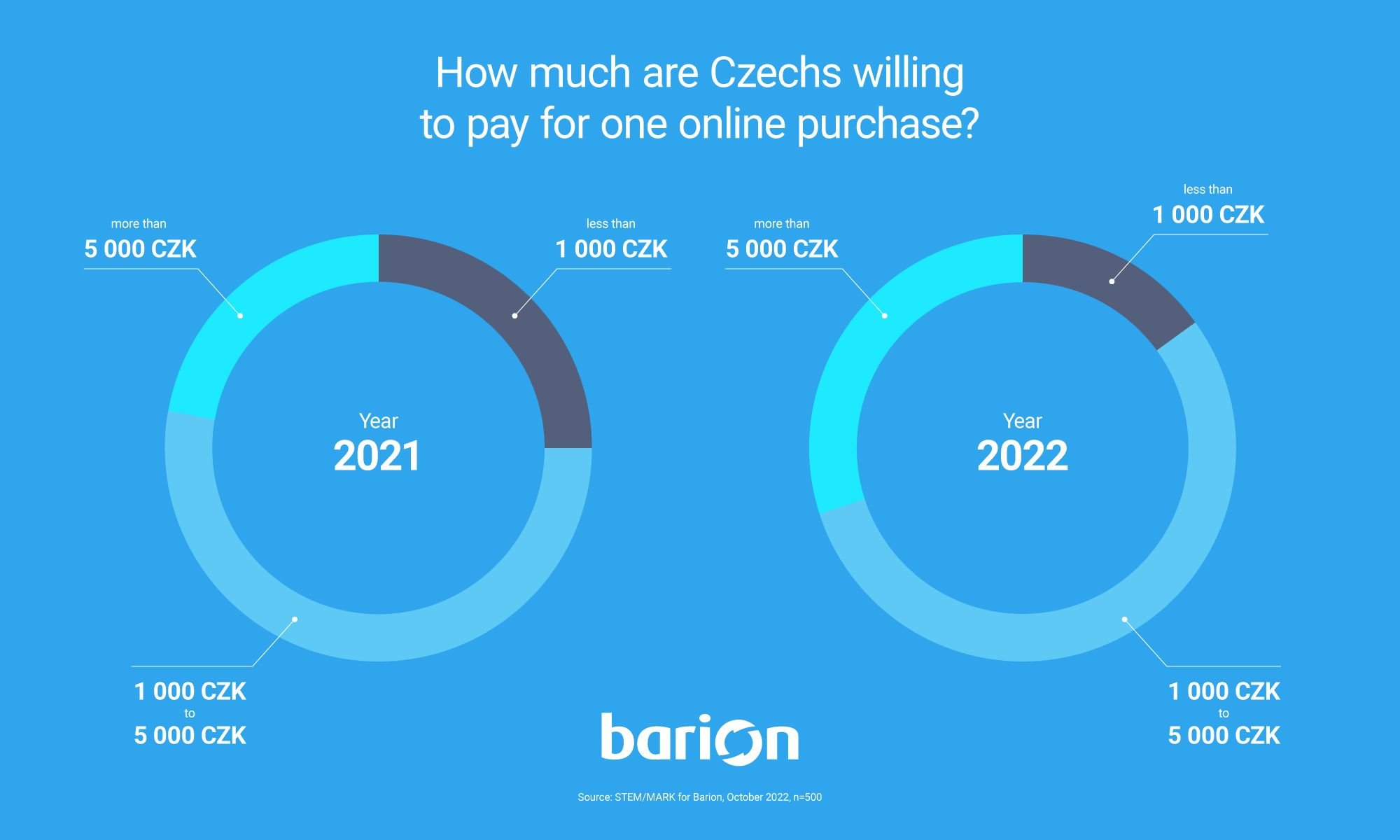

The latest online payment trends in the Czech Republic

Catch up with the latest trends and tendencies of the e-commerce sector and digital payments in the Czech Republic.

FinTech

October 10, 2022

What are digital wallets and how do they boost your conversion rate?

Everything you wanted to know about digital wallets, all in the same place.

FinTech

November 21, 2022

What is a virtual IBAN and how does it help your business grow?

How do virtual IBAN account numbers help you with foreign money transfers and why do they make digital wallets even more powerful?

Facebook

Facebook Discord dev community

Discord dev community @BarionPayment

@BarionPayment