November 30, 2022

●

According to Global Payments Report, nearly half (48.6%) of online transactions were done via digital wallets in 2021. But how does that figure translate to the Czech market? Does the pandemic have any lingering effects (positive or negative) on e-commerce and online payments in general? We’re recapping the latest trends in this article.

Online checkouts vs cash on delivery: slow shift💵

European trends show an increased preference for credit and debit cards in online payments, and this is no different in the Czech Republic either. According to a survey conducted by Barion this November, 49.5% of respondents prefer online shopping using their credit cards. While this figure is encouraging, a significant amount of shoppers still prefers bank transaction (14.5%), and the second largest group picks the rather old-school cash-on-delivery method (19.8%).

The rise of digital wallets👛

While still only the fourth most popular payment method on the list, digital wallets have made a splash this year. Compared to 2021, the number of digital wallet users has doubled: last year, only 7% chose providers like Apple Pay, Google Pay, or Barion Wallet, while the latest survey shows that this figure rose to 12.3%, getting ever so closer to bank transfers in popularity. This shows that there’s still plenty of room for improvement: with the global figure closing in at 50%, the Czech Republic (just like most European countries) is somewhat behind the latest trends in the payment industry.

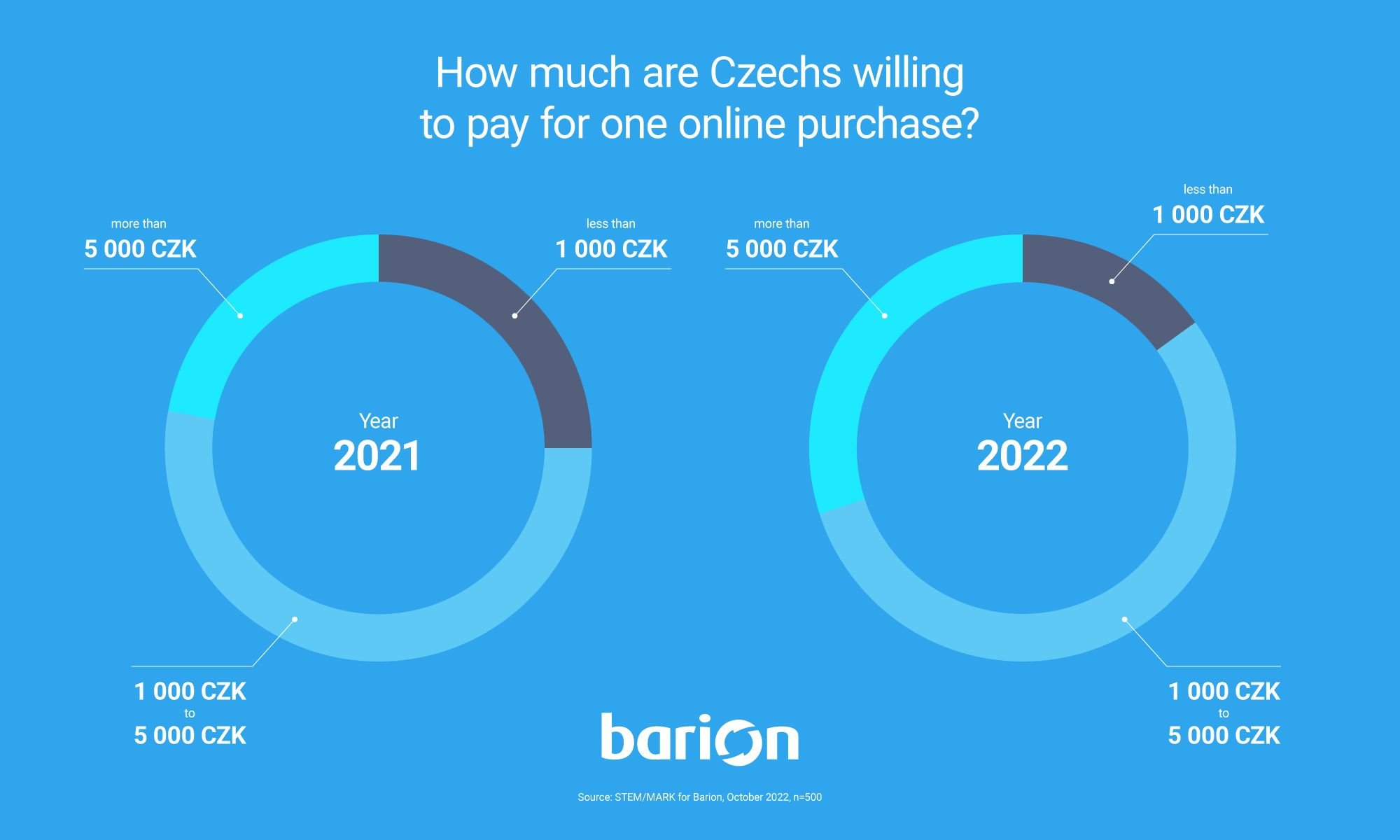

Willingness to pay: fluctuations both way🗠

Market tendencies show that the spread of digital payment methods and contactless payments boosts the overall trust of customers in these novelties. The pandemic clearly helped in this tendency: in 2021, a majority of European consumers felt comfortable with raising their contactless limit above €150 per transaction. This trend can be applied to online payments as well as Czech respondents paint a similar picture: in 2022, 30% of customers were willing to spend more than 5000 CZK (205 EUR) on a single purchase, while 2021 data shows a lower figure (22%).

Most respondents (55%) shop for between 1000-5000 CZK (40-205 EUR), which is pretty much the same data point from last year (53%). Somewhat contradicting the above findings, the number of users willing to spend 1000 CZK (40 EUR) or more on a single purchase has decreased by 10% (from 25% to 15%).

Slow shift according to global trends📈

All in all, the survey shows that, even though slowly, the Czech market is catching up to global trends. The quick spread of digital wallets and the shrinking cash on delivery payments show that the safest and most modern payment methods will eventually prevail – and just by comparing data from 2021, it’s clear that the change is inevitable.

More like this

FinTech

October 28, 2022

How do payment gateway providers hide their fees?

Transaction fees, monthly subscriptions, no flat rates - payment providers have many options to hide their fees. We listed them all to help you make the best offer on the market.

FinTech

October 10, 2022

What are digital wallets and how do they boost your conversion rate?

Everything you wanted to know about digital wallets, all in the same place.

FinTech

November 21, 2022

What is a virtual IBAN and how does it help your business grow?

How do virtual IBAN account numbers help you with foreign money transfers and why do they make digital wallets even more powerful?

Facebook

Facebook Discord dev community

Discord dev community @BarionPayment

@BarionPayment